TOTAL LOSS VEHICLE APPRAISAL AND NEGOTIATION SERVICES

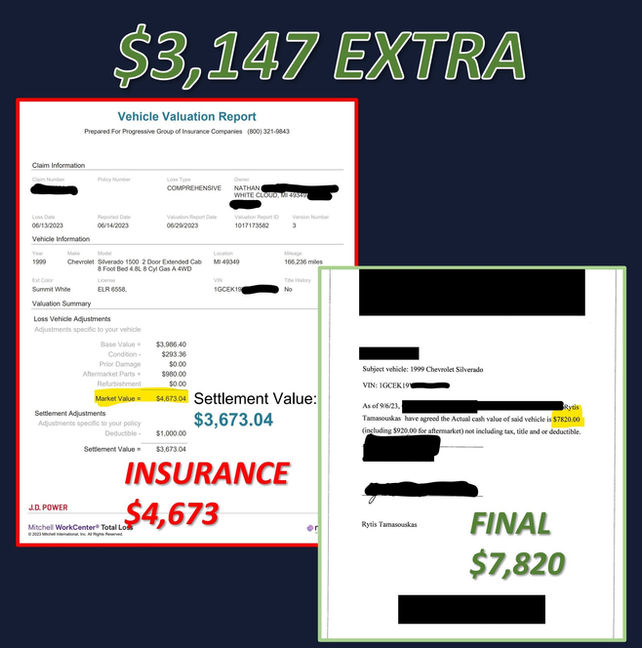

Most Insurance Valuations Are 20-40% Below Market Value And Sometimes Much More.

We Help You Get A Fair Payout.

No Result, No Charge.

OUR WORK

WHY IT WORKS

Different Arena of Negotiations

✓ We Invoke The Appraisal Clause

The insurance company then has to hire an independent appraiser to represent them, and we represent you as an independent appraiser also.

✓ Remove Bias

This takes the insurance company and their biased valuation software out of the negotiation completely.

✓ Accurate Value

The value is then determined together by two highly experienced independent appraisers.

THE PROCESS

How we get extra settlement:

1

Get Insurance Offer

Not yet deemed a total loss?

No worries, let's wait for the decision.

If totaled out, we'll wait for the insurance offer to determine if insurance offer is fair.

2

Invoke Appraisal Clause

We invoke the appraisal clause on your behalf and have the insurance company hire an independent appraiser to represent them.

3

Negotiations

We work with the opposing appraiser to come to a fair middle ground value for your vehicle.

Once we have a value, we both sign off on the Appraisal Award Letter.

4

Get Insurance Check

The Signed Appraisal Award Letter is sent to the insurance company for final payout based on the new value.

FREQUENTLY ASKED QUESTIONS

1. How do I know if I can get more? Whether you can get more for your vehicle depends on the offer from your insurance company and the actual market value of your vehicle. Give us a call, and we'll do a free appraisal and let you know if there's room for a higher settlement.

2. How long does this take? Once the vehicle is determined a total loss, it typically takes 4-7 business days for our process to complete. It all depends on how quickly the insurance company and their appraisers work.

3. How is the value determined? To determine value we take into account current day comparable vehicles in the local market, and make adjustments for the options/packages, mileage, condition of your vehicle. As well as any recent repairs or maintenance, and aftermarket parts.

4. What are the costs associated with your appraisal services? Our fees vary based on the type of appraisal service and the complexity of your case. We offer a transparent pricing structure, which will be clearly explained during your initial consultation, ensuring there are no surprises.

5. When is payment due for your service? Payment for our services will be due upon you receiving your final settlement check from the insurance company.

6. Can you take the fee out of the settlement check? No, unfortunately insurance company policies do not allow for that. Payment must be made "out of pocket" after you receive the final settlement check.

7. Is there any risk? There is no risk. Your first offer from the insurance company is always yours to keep. As such, you'll never end up below your first offer.

8. Do I need to provide any documentation? The only documentation we will need is a copy of your insurance offer. This most commonly appears in the form of the CCC One Valuation report or the Mitchell Valuation report.

9. Does this apply to Leased Vehicles? Yes! Often times insurance companies will pay out just enough to cover the lease payoff. We can assist you with getting some money back out of the lease vehicle.

ABOUT US

Welcome to Auto Value Appraisals in Metro Detroit, your trusted partner for fair and precise automobile appraisals.

Born from a passion for cars and a desire to challenge unfair insurance practices, we specialize in advocating for vehicle owners in total loss situations.

We understand the frustration of undervalued vehicles and are here to ensure you receive the settlement you deserve.

Let us put our expertise to work for you. Contact us for a fair appraisal and start your journey to a rightful settlement today.

📞 Tel: (248) 952-8248

📧 Email: Info@AutoValueAppraisals.com

Location: 21366 Hall Rd, Clinton Township, MI 48038

You can also request for us to contact you using the form below: